The Concept of Carbon Credits

Navigating the expansive landscape of renewable energy and sustainability, one is likely to encounter the term ‘carbon credit.’ These two words carry immense weight in our collective fight against climate change. They are much more than a buzzword, influencing a spectrum far beyond conventional energy sources, extending into off-grid energy systems.

A carbon credit is a tradable certificate or permit, providing the holder the right to emit one tonne of carbon dioxide or the equivalent amount of a different greenhouse gas. Governments and international organisations devised these credits to incentivise businesses to reduce their carbon footprints, essentially treating carbon credits as an environmental currency.

Off-Grid Energy Systems and Carbon Credits: A Profound Connection

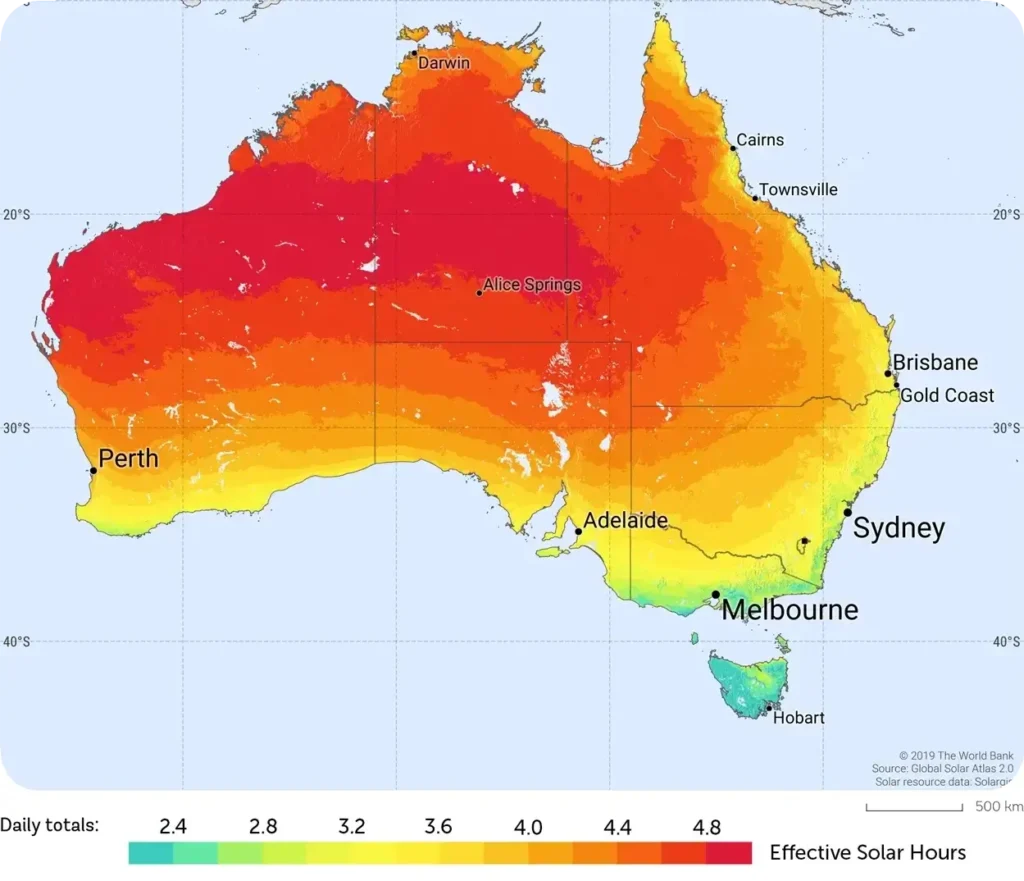

Off-grid energy systems represent power systems independent of the main power grid, often harnessing renewable energy sources such as wind, solar, or hydroelectric power. They offer a cleaner, more sustainable method of producing energy, which is particularly valuable in remote areas where grid connectivity may not be feasible.

The correlation between off-grid energy and carbon credits stems from the former’s capacity to reduce emissions. Off-grid projects that use renewable sources displace potential fossil fuel use, preventing the release of harmful greenhouse gases into the atmosphere. This averted emission translates into carbon credits.

Generating Carbon Credits: An Added Revenue Stream

Carbon credits can serve as an additional revenue stream for off-grid energy projects, enhancing their financial viability and appeal to investors. This aspect is crucial, especially for developing countries, where the initial investment for off-grid solutions may be high.

Beyond the Exchange of Permits: Changing Our Approach

The intersection of off-grid energy and carbon credits goes beyond the mere exchange of permits. It’s about changing our approach to energy consumption, using market-based solutions to accelerate the transition towards a carbon-neutral world.

Off-grid energy projects, supported by carbon credits, present a viable path towards this goal. They not only reduce dependence on fossil fuels, but they also promote energy security, resilience, and local job creation, contributing to a greener and more equitable society.

Concluding Thoughts: Towards a Carbon-Neutral Future

In summary, carbon credits serve as a pivotal tool in combating climate change, acting as an incentive for businesses to reduce carbon emissions. The symbiosis of carbon credits with off-grid energy projects leads to a scenario where each tonne of CO2 equivalent averted translates into a tradable permit, fostering emission reductions. Embracing this synergistic approach, we move one step closer to a sustainable, carbon-neutral future.